Welcome to Spicy Sunday Finance 🌶️

Happy Sunday! This week’s podcast episode and newsletter is all about how you think, how you make decisions and how you show up for yourself every single day. Because “investing” isn’t just what you do with your money it’s about how you treat it and how you use it to build the life you want.

We’re diving into 10 ways to invest in your future self — finance edition.

🎧 Podcast Episode 8 Recap: 10 Ways to Invest in your Future Self | money habits, ways to level up your finances & getting inspired

💬 Let’s Talk About “Future You”

Your future self is being shaped by the choices you make today. Every decision matters and just like how money compounds, so do your actions. It’s not always the big, dramatic moves that create lasting change because it’s the small, consistent steps you take, right now, that build momentum over time.

So ask yourself: what’s one thing you can do today that your future self will thank you for? If you’re needing that extra push or motivation to level up your personal finances, give the podcast episode a listen! Let’s get your future YOU in motion by what you decide NOW.

🔑 The 10 Ways to Invest in YOU (Finance Edition)

Ten is already a lot to take in, but I believe the more ideas you have, the more options you have to pick and choose from. Investing in yourself takes energy (I get it), but as I get older, I’m realizing that the earlier you understand the power of investing in your mental and physical well-being, the more you’re going to get out of it later down the road. It’s just like investing your money. I’m all about finding pockets of inspiration, so here are the ten ways to level up the mindset you need to set yourself up for success.

Rewiring your money habits

Staying on your own timeline

Building your financial literacy knowledge bank

Scheduling a “Money Maintenance Day”

Mastering the five pillars of personal finance

Setting up THE ROUTINE

Delaying your gratifications

Curating your circle

Growing your skill sets

Treating money like a relationship

These are some ways I personally practice and apply to my own journey. To dive deeper into the 10 ways on how these all work, you can listen to this week’s podcast episode on Spotify 🎧

🧰 Projects I’m Working On Before 2026

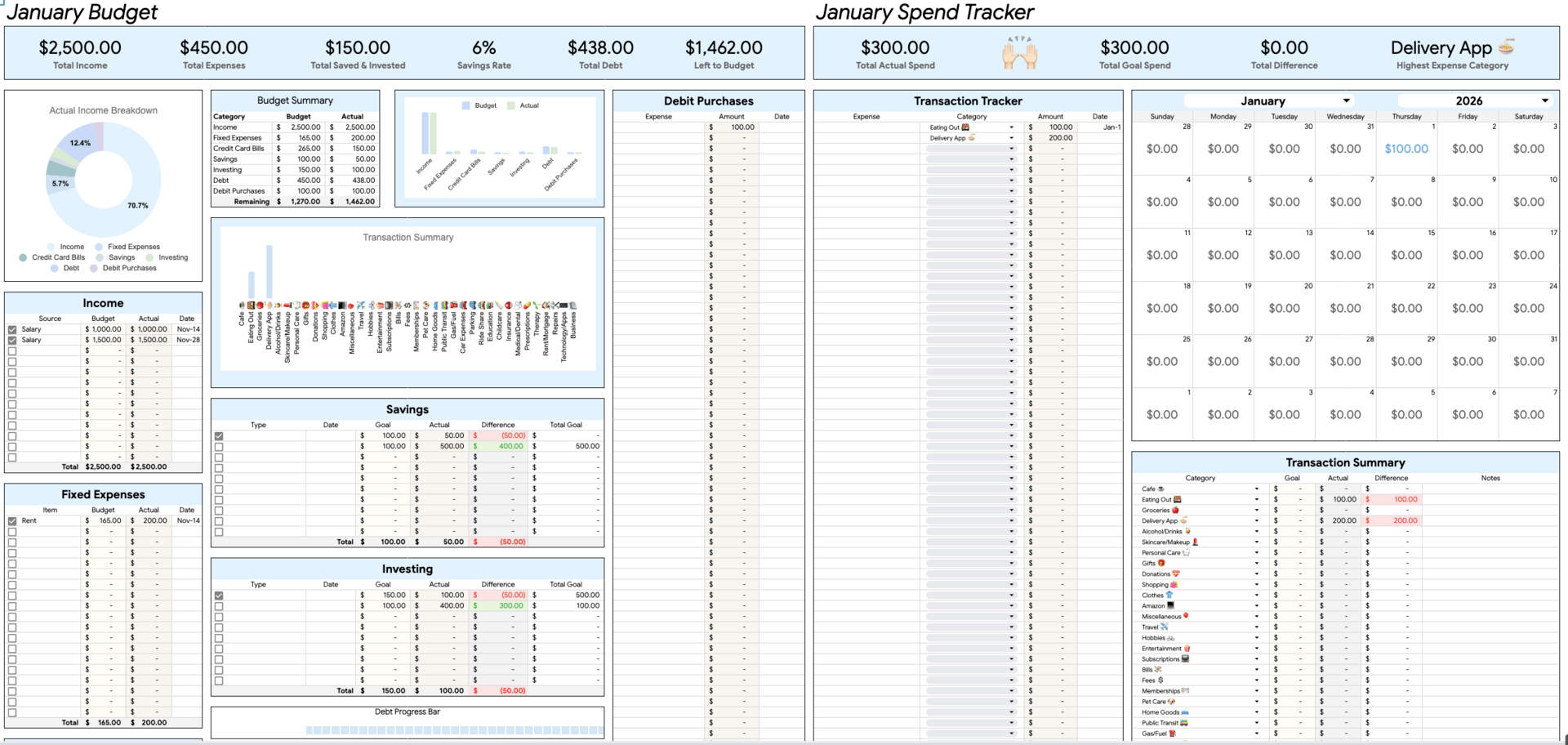

I’m currently working on a big update for the Budgeting Template, packed with new features to make money tracking easier and more customizable than ever. You’ll soon be able to add your own categories, with everything updating automatically (so no more manual edits)! The new version will also include debt progress tracking, budget vs. actual columns to help you plan ahead, and a completely redesigned dashboard that summarizes your yearly money moves at a glance.

This upgraded spreadsheet is a fresh, improved version of the current one, and I’m even adding a customization option where I will be personalizing colour choices for all purchases in December. I’m sharing sneak peeks and progress updates on Instagram, so be sure to follow along there!

Sneak peek of what it looks like! If you have feedback or any suggestions before the final version launches middle of December, let me know!!!

If you haven’t checked it out yet, I recently created a Credit Card Combo Guide on FinlyWealth, featuring five carefully curated card combinations that work seamlessly together. I’m all about optimization, and personally, my sweet spot is three cards, which is why every combo in the guide comes in triplets. My idea for that is simple: you don’t need more than one card from each network (Visa, Mastercard, and Amex).

Many of the cards in the guide also offer rebates or welcome bonuses, which can help offset annual fees or even earn you a little extra back. Any card you apply for through the guide supports me directly (they’re affiliate links) so I’d be honoured if you use my link!

No pressure to open new credit cards at all! You are more than welcome to also switch or upgrade existing cards and just apply the logic I outline in the guide to create your own optimized setup.

✨ Final Thoughts

With only a handful of weeks left in 2025, I want you to make every decision count. I’m in the same boat: gearing up for the new year, pushing through personal projects, setting growth goals for my social media, and finding new ways to create personal finance content that educates and inspires every day.

So whether your goal is to level up your finances or hit new personal milestones, remember that every thought, action, and step matters. Procrastination always make its way to my house somehow but I’ve learned that getting out of it and making that next step feels lighter when you take it one step at a time instead of planning too far ahead.

Here’s to investing in the version of yourself who embodies peace, freedom, and stability so that your future self can look back and be proud of how far you’ve come. 💛

If this newsletter got you motivated, I’d love for you to:

💌 Stay Connected

Until next week ✨

Cheers,

Jane